Uniper's business and corporate segments

Uniper Group

Uniper Group

Düsseldorf-based Uniper is an international energy company with operations in more than 40 countries and with some 7,000 employees. Its business is the secure provision of energy and related services in an increasingly decarbonizing environment in accordance with the requirements of energy and climate policy and the regulatory environment, as well as related voluntary commitments.

Uniper procures gas – including liquefied natural gas (LNG) – and other energy sources on global markets. The company owns and operates gas storage facilities with a capacity of more than 7 billion cubic meters. Uniper plans for its 22.4 GW of installed power-generating capacity in Europe to be carbon-neutral by 2035. The company already ranks among Europe’s largest operators of hydroelectric plants and intends to further expand solar and wind energy, which are essential for a more sustainable and autonomous future.

Uniper is a reliable partner for communities, municipal utilities, and industrial enterprises for planning and implementing innovative, lower-carbon solutions on their decarbonization journey. Uniper is a hydrogen pioneer, is active worldwide along the entire hydrogen value chain, and is conducting projects to make hydrogen a mainstay of the energy supply.

2023 Key Figures

Green Generation

Green Generation

Uniper plans to contribute to decarbonization by increasing climate-neutral electrification and aims to significantly expand its green generation capacities. Uniper already has a significant portfolio of climate-neutral power generation. CO2-free energy sources currently account for around 20% of Uniper's generation capacity. These consist of the hydroelectric power plants in Germany and Sweden, which have a combined capacity of 3.6 GW, and nuclear power in Sweden, which has a generation capacity of 1.4 GW. Together, this results in annual electricity generation of approximately 23 TWh. At these plants, Uniper focuses on valueadded management and at the same time assesses whether further hydroelectric projects can meaningfully complement Uniper's green portfolio.

In addition, renewable energies will play a key role in Uniper's climate-neutral electricity generation in the future. Of the total investment volume of over eight billion euros in growth and transformation, a significant portion will be allocated to the development of the renewable electricity portfolio. Uniper plans to invest in the development, construction and operation of onshore wind and solar plants.

2023 Key Figures*

*New segmentation effective from 1 January 2024. Figures are illustrative.

Flexible Generation

Flexible Generation

The "Flexible Generation" segment combines all generation capacities that contribute to ensuring grid stability and security of supply, making them key building blocks for the energy transition in Uniper's core markets.

Uniper currently owns and operates around 6 GW of hard coal-fired capacity in Europe. To achieve the reductions in emissions outlined above, Uniper has presented a shutdown plan for its hard coal-fired power plants that will save up to 18 million tons of CO2 per year. The decline in the flexible electricity generation capacity available on the market as a result of the coal phase-out and the simultaneous expansion of electricity generation from renewable energies increase the importance of flexible gas-fired power plants and and gas and steam plants for the energy transition. These plants should counter the increasing generation volatility in the electricity market and ensure the secure operation of the electricity supply systems. Uniper has around 9 GW of gas-fired power plants in Germany, the Netherlands, the United Kingdom and Hungary, making it well positioned to play an important role in the energy transition. Uniper will review options for converting the gas-fired power plants to run on alternative fuels such as biofuels and green hydrogen. In principle, Uniper is prepared to make considerable investments in new, modern and flexible power plants that provide for the possibility of subsequent decarbonization at the time of the investment decision. This also includes energy storage solutions.

2023 Key Figures*

*New segmentation effective from 1 January 2024. Figures are illustrative.

Greener Commodities

Greener Commodities

Uniper remains a reliable partner for municipal utilities and industrial customers in the gas sector. With a volume of over 200 TWh of gas per year and over 0.9 TWh of biomethane per year, Uniper currently supplies around 1,000 customers, including numerous municipal utilities and industrial companies. Uniper considers one of its most important tasks to be further diversifying its gas portfolio in the future. Uniper is currently one of the largest gas storage operators in Europe with 7.3 billion cubic meters (m³) of gas storage capacity in its portfolio. Uniper continuously evaluates solutions to enable the conversion of existing storage facilities for the storage of hydrogen, provided that an economically scalable technical implementation is possible.

Uniper also aims to increase the proportion of green gases in its portfolio, which are expected to account for five to ten percent of the gas portfolio by 2030 in line with market developments. Green gases are also part of many customers' own decarbonization measures. Uniper will supply its customers with various green gas products such as hydrogen, biomethane and ammonia, thereby supporting decarbonization across Germany and Europe in addition to its own.

Green hydrogen in particular is also expected to contribute to the decarbonization of sectors that are difficult or impossible to electrify - such as chemicals, steel and aviation. These sectors require low-carbon gaseous and liquid fuels for decarbonization. As a hydrogen player, Uniper has many years of experience in the operation of hydrogen plants. Uniper is one of the first European utilities to use green hydrogen based on electrolysis processes. As part of its new strategy, Uniper views hydrogen as one of its strategic priorities. Uniper plans to build an installed electrolyzer capacity of over 1 GW by 2030. In addition, Uniper intends to promote the import of green energy sources.

Besides investing in onshore wind and solar, Uniper will further expand its already well-established portfolio of long-term solar and wind power purchase agreements (PPAs). These long-term PPAs create the basis for the direct purchase of electricity generated from renewable sources and enable Uniper to expand its renewable energy portfolio on the basis of long-term contracts.

2023 Key Figures*

*New segmentation effective from 1 January 2024. Figures are illustrative.

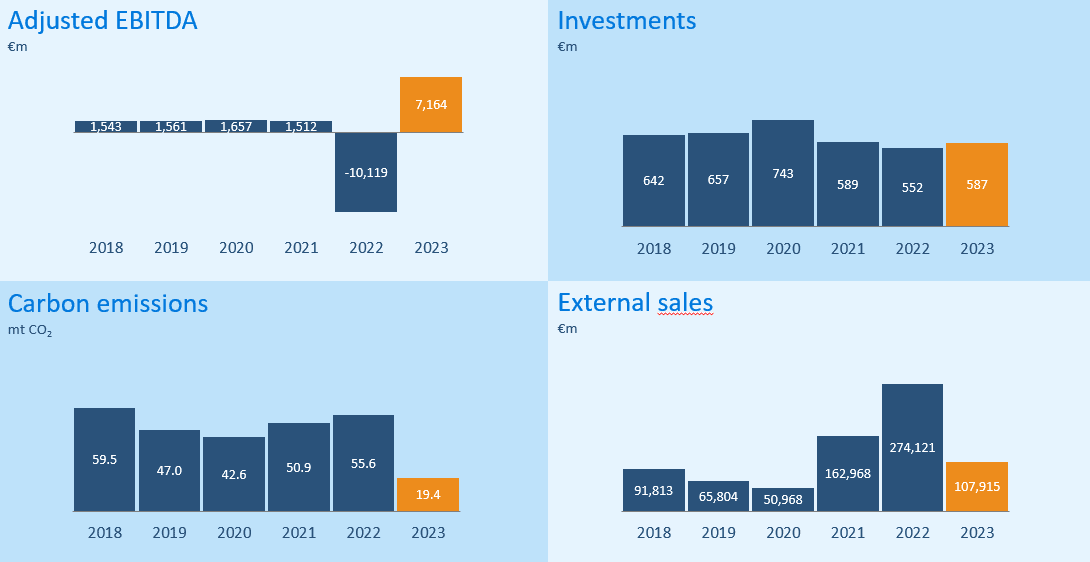

Key figures at a glance

Note: Russian Power Generation business division classified as discontinued operations in 2022, prior year figures shown as reported.

Unit |

2023 |

2022 |

2021 |

2020 |

2019 |

2018 |

|

|---|---|---|---|---|---|---|---|

Sales |

€ in millions |

107,915 |

274,121 |

163,979 |

50,968 |

65,804 |

91,813 |

Adj. EBITDA1 |

€ in millions |

7,164 |

-10,119 |

1,512 |

1,657 |

1,561 |

1,543 |

Adj. EBIT1 |

€ in millions |

6,367 |

-10,877 |

955 |

998 |

863 |

865 |

Net income/loss1 |

€ in millions |

6,336 |

-19,144 |

-4,106 |

402 |

644 |

-442 |

Earnings per share2 |

€ |

15.15 |

-661.75 |

-11.39 |

1.08 |

1.67 |

-1.1 |

Adj. Net Income1 |

€ in millions |

4,432 |

-7,401 |

743 |

774 |

614 |

n/a |

Dividend per share2 |

€ |

0.00 |

0.00 |

0.07 |

1.37 |

1.15 |

0.9 |

Cash provided by operating activities (operating cash flow) |

€ in millions |

6,549 |

-15,556 |

3,296 |

1,241 |

932 |

1,241 |

Investments |

€ in millions |

587 |

552 |

589 |

743 |

657 |

642 |

Growth |

€ in millions |

198 |

189 |

293 |

406 |

297 |

325 |

Maintenance and replacement |

€ in millions |

389 |

363 |

297 |

336 |

361 |

317 |

Economic net debt |

€ in millions |

-3,058 |

3,410 |

324 |

3,050 |

2,650 |

2,509 |

Note: Russian Power Generation business division classified as discontinued operations in 2022, prior year figures shown as reported.

1. Adjusted for non-operating effects.

2. Basis: outstanding shares as of reporting date.

Unit |

2023 |

2022 |

2021 |

2020 |

2019 |

2018 |

|

|---|---|---|---|---|---|---|---|

Power procurement and owned generation |

Billion kWh |

210.3 |

289.7 |

413.6 |

558.0 |

616.8 |

709.0 |

Electricity sales |

Billion kWh |

209.5 |

288.9 |

412.9 |

552.9 |

612.7 |

707.0 |

Gas volume sold |

Billion kWh |

1,637.7 |

1,661.5 |

2,258.5 |

2,205.9 |

2,179.3 |

2,109.3 |

Direct carbon emissions fuel combustion |

Mio t CO2 |

19.4 |

55.6 |

50.9 |

42.6 |

47.0 |

59.5 |

Carbon intensity1 |

g/kWh |

355.8 |

477.5 |

454 |

453 |

445 |

499 |

Employees as of the reporting date |

6,863 |

7,008 |

11,494 |

11,751 |

11,532 |

11,780 |

|

Proportion of female employees |

% |

26.3 |

24.5 |

25.4 |

25.2 |

24.6 |

24.2 |

Average age |

Years |

46 |

46 |

45 |

45 |

45 |

44 |

Employee turnover rate |

% |

5.3 |

4.9 |

4.4 |

3.7 |

4.5 |

4.7 |

Note: Russian Power Generation business division classified as discontinued operations in 2022, prior year figures shown as reported.

1. Uniper’s carbon intensity is defined as the ratio between direct fossil-fuel-derived CO₂ emissions from electricity and heat generation from Uniper’s fully consolidated stationary facilities (financial control approach) and Uniper’s generation volume. This indicator does not include facilities that produce only heat and/or steam.

€ in millions |

2023 |

2022 |

+/- % |

|---|---|---|---|

Electricity |

23,664 |

66,013 |

-64.2 |

Gas |

78,733 |

191,421 |

-58.9 |

Other |

5,519 |

16,687 |

-66.9 |

Total |

107,915 |

274,121 |

-60.6 |

Note: Russian Power Generation business division classified as discontinued operations in 2022, prior year figures shown as reported.

€ in millions |

2023 |

2022 |

+/- % |

|---|---|---|---|

European Generation |

2,257 |

741 |

204.4 |

Global Commodities |

4,104 |

-11,232 |

136.5 |

Administration/Consolidation |

7 |

-387 |

101.7 |

Total |

6,367 |

-10,877 |

158.5 |

Note: Russian Power Generation business division classified as discontinued operations in 2022, prior year figures shown as reported.

Essential reports and presentations

Annual Report

Sustainability Report

Our assets

Latest reports and presentations

Better informed about the latest developments at Uniper: Find all relevant publications as part of our regular financial reporting.